Guide to Registering the Tax Code (TAX) Suffix 888

Posted on: 28/02/2025

Currently, individuals and business households selling goods on e-commerce platforms or social media need to register for a tax number with the suffix 888 to ensure full compliance with tax declaration and payment obligations.

Here are the steps to quickly and accurately register for a tax number with the suffix 888 online:

Step 1: Access the electronic tax registration system

Visit the Electronic Tax Portal at: https://canhantmdt.gdt.gov.vn

Click on "Login with Electronic Identification Account"

Enter your personal identification number (CCCD number) and password, or use the VNeID app to scan the QR code to log in.

Once logged in successfully, the system will redirect you to the main interface of the Electronic Tax Portal.

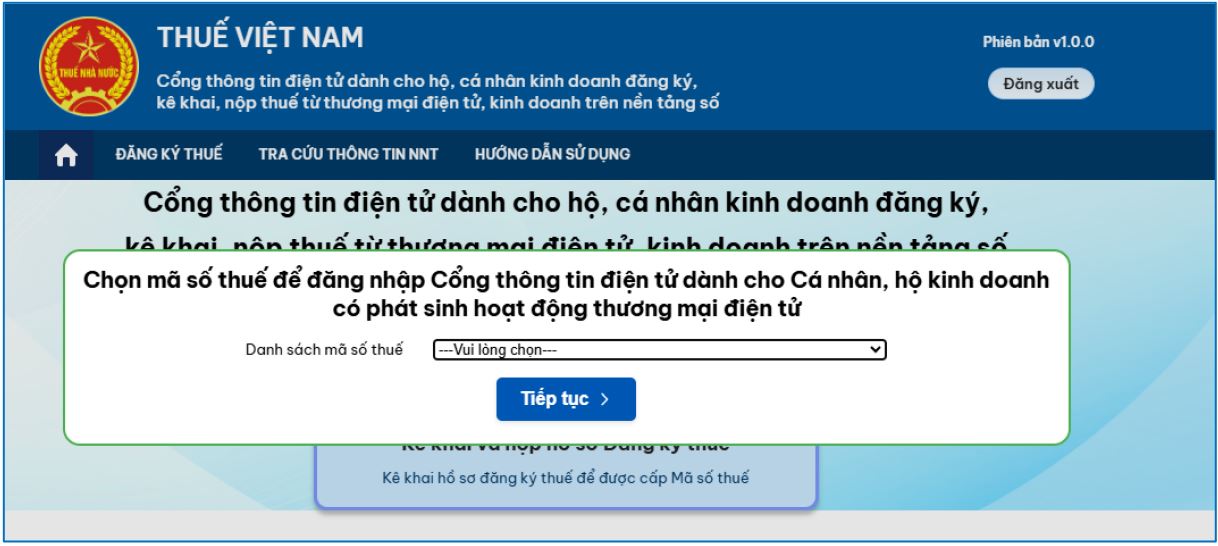

Step 2: Select the function to register for a tax number with the suffix 888

On the homepage interface, select the "Tax Registration" section.

Then, click on "Declare and Submit Tax Registration Documents" and click "Continue" to proceed to the information entry section.

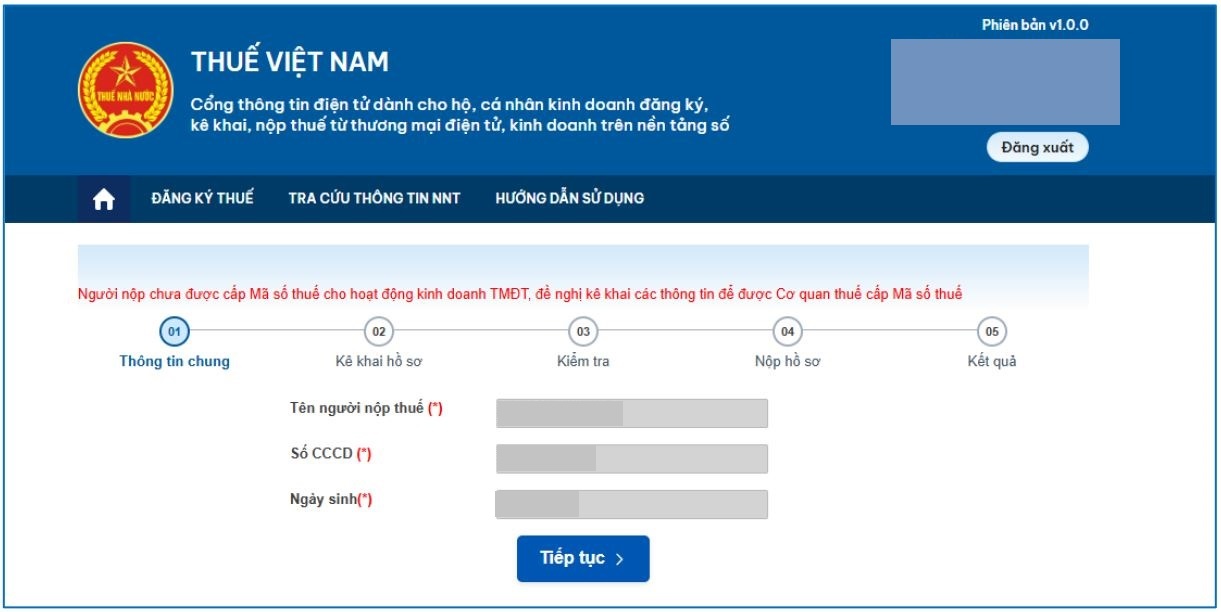

Step 3: Fill in the tax registration declaration form

After completing Step 2, the system will display the tax registration form with the suffix 888 for individuals and businesses on e-commerce platforms. There will be a total of 13 information fields, and you only need to fill in the mandatory (*) fields. Here's how to complete them:

-

Taxpayer's Name

The system will automatically display the name based on the VNeID information, no need to edit.

-

Tax Number (if applicable)

If you already have a personal tax number, the system will display it automatically.

-

Tax Agent Information (This field is not editable by the system)

-

Business Address

If the address displayed by the system is incorrect, you can update it to the actual business address. Detailed entry process:

-

Field 4a: Enter house number, street, village/hamlet.

-

Field 4b: Enter ward/commune/town.

-

Field 4c: Enter district/city/town.

-

Field 4d: Enter province/city.

-

Field 4e: Enter phone number and email.

-

Tax Notification Address

If different from the business address, you need to fill in the full information.

-

Information of Business Household Representative, including:

-

Full name: Automatically updated by the system.

-

Registered permanent address: Automatically updated by the system.

-

Current residence: If incorrect, you can update it.

-

Other information: Phone number, email (not mandatory).

-

Business Registration Certificate (if available)

If you have a business registration certificate, enter the license number in this field.

-

Personal Document Information

Enter the issue date of your CCCD and select the issuing authority. The system will automatically fill in other fields.

-

Business Capital (Not mandatory)

If you want to declare business capital, enter the amount here.

-

Main Business Activities

Select the appropriate industry code for your business activity. For example, if you sell on Shopee, select industry code G47910.

-

Start Date of Activity

Enter the official date your online business started.

-

Tax Registration Status

Select "New Registration" if this is your first time registering for a tax number with the suffix 888.

-

Related Unit Information (This field does not need to be filled in).

Once completed, click "Continue" to review the information before submitting.

Step 4: Confirm and Submit the Registration Application

After completing the tax registration declaration form with the suffix 888, the next step is to confirm and submit the application to complete the process. After carefully reviewing the information, proceed with the following steps:

-

Enter the captcha code displayed on the screen to verify that you are not a robot.

-

Click the "Continue" button to proceed to the confirmation step with the OTP code sent to the registered phone number.

Note:

-

The OTP code is only valid for a short period, so be sure to enter it as soon as you receive it.

-

If you do not receive the OTP code, check the registered phone number again or click "Resend OTP" to get a new code.

Step 5: Check the Tax Number with the Suffix 888 After Registration

Once you successfully enter the OTP code, the system will display a message saying "Congratulations, your registration has been successfully submitted," and issue your tax number with the suffix 888. Your new tax number will be in the following format:

[Personal Tax Number] – 888

At this point, you have completed all the steps to register your business tax number with the suffix 888. Be sure to save this tax number for future tax declarations and submissions.

Hệ thống văn phòng :

🔹Trụ sở chính: 702/63/7 Lê Đức Thọ, Phường An Hội Đông, TP. Hồ Chí Minh

🔹VPĐD tại Đà Lạt: 72 Nguyễn Công Trứ, Phường Lâm Viên - Đà Lạt, Tỉnh Lâm Đồng

🔹VPĐD tại Kon Tum: 227 Phan Đình Phùng, Phường Đăk Cấm, Tỉnh Quảng Ngãi

🔹VPĐD tại TP. HCM: 779 Huỳnh Văn Lũy, Phường Bình Dương, TP. Hồ Chí Minh

🔹VPĐD tại Gia Lai: 59 Trường Chinh, Phường An Nhơn Đông, Tỉnh Gia Lai

🔹VPĐD tại Bảo Lộc: 48/49 Phạm Ngọc Thạch, Phường 1 – Bảo Lộc, Tỉnh Lâm Đồng

🔹VPĐD tại Hà Nội: Phòng 701, Tòa nhà Kim Ánh, Số 1 ngõ 78, Phường Cầu Giấy, TP. Hà Nội

CÔNG TY TNHH ĐÀO TẠO & TƯ VẤN THTAX

📌 702/63/7 Lê Đức Thọ, Phường An Hội Đông, TP.HCM

📞 0934 518 268 – 0918 774 497